Taitron Components Inc (NASDAQ:TAIT) has been growing steadily over the last few years. The need for electronic components continues to grow as more products require additional chipsets. This is a stark contrast to Taitron’s previous experience during the declining component requirements from tightening consumer spending on electronics in the years 2013 to 2016. Consumer tightening has begun again which could eat into Taitron’s recent performance surge. This is especially true due to the order-by-order basis of Taitron’s sales, making an immediate impact felt from reduced component needs.

Taitron is also a small fish in a big pond. The competitive landscape in these components not only includes other third-party manufacturers but potential customers of Taitron also have in-house manufacturing facilities. Difficulty in marketing and capturing business can be linked to poor name recognition and Taitron’s size. Due to the intense competition, Taitron could end up in price wars eating away at its margin and making it difficult to compete with more well-established players.

Recently Taitron has begun to execute a more targeted strategy with high-margin ODM (Original Design Manufacturer) projects that require specific components. This is very different from its previous superstore strategy of maintaining a vast quantity of electronic components to fill customer needs immediately. The impact on inventory loss should be somewhat mitigated by this change because of not having to hold as much inventory that could be obsolete due to need or technological changes. Whether this is a viable long-term due to the price wars and the difficult competitive environment remains to be seen in 2023 and beyond.

When considering these current stories about Taitron Components, we need to determine which news topics will have a long-term and ongoing effect on the company and its share price. Chipset needs will continue to rise, which should provide sales to Taitron components sectors. Taitron’s more tailored strategy to provide specialized components to companies could allow it to separate itself from the competitive landscape of more standardized components. It remains to be seen if Taitron can execute its strategic objectives due to its relatively small size in an environment of large competitive pressure. Taitron also faced a sales decline in its most recent quarter mainly due to a consumer spending pullback. Regardless of the decline, Taitron has continued to offer its dividends to investors. Overall, Taitron has managed a remarkable turnaround since 2013 but there is worry the competitive and market landscape could prove difficult for this smaller sized company in this industry.

While current news stories, good or bad can sway our opinion about investing in a company, it’s good to analyze the fundamentals of the company and to see where it’s been in the past and in which direction it’s heading.

This article will focus on the long-term fundamentals of the company, which tend to give us a better picture of the company as a viable investment. I also analyze the value of the company versus the price and help you to determine if Taitron Components is currently trading at a bargain price. I provide various situations which help estimate the company’s future returns. In closing, I will tell you my personal opinion about whether I’m interested in taking a position in this company and why.

Snapshot of the Company

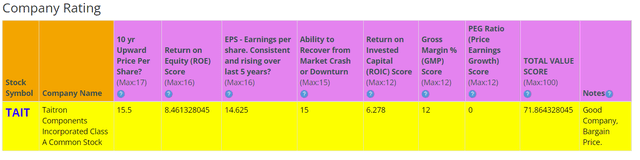

A fast way for me to get an overall understanding of the condition of the business is to use the BTMA Stock Analyzer’s company rating score. Taitron Components shows a score of 71.86 out of 100. In summary, Taitron Components has decent fundamentals, but there is plenty of room for improvement.

Before jumping to conclusions, we’ll have to look closer into individual categories to see what’s going on.

BTMA Stock Analyzer

Fundamentals

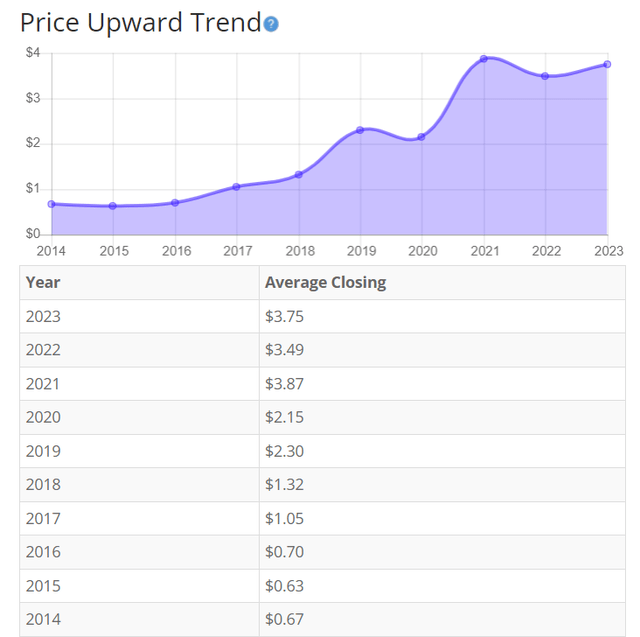

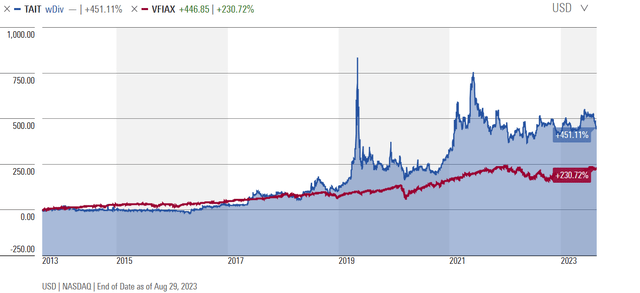

The share price has steadily risen over the past 10 years. Increased sales and improved efficiency continue to help directly with Taitron’s fundamentals. Component shortages helped to boost smaller market cap suppliers because of the hope of mitigating time delays for components at OEM manufacturers. With recent guidance expecting a pullback, the share price could decline in the short term. Overall, the share price average has grown by about 459.70% over the past 10 years, or a Compound Annual Growth Rate of 18.8%. This is a great return.

BTMA Stock Analyzer

Earnings

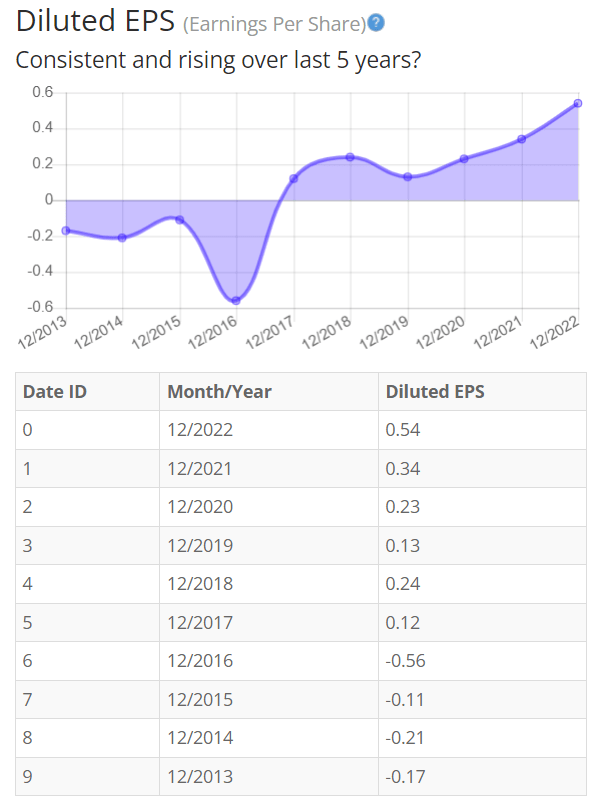

Earnings saw a reversal after 2017 and saw a steady rise since then. Mobile phones and personal computer pullback during those earlier years made component needs decline. As component shortages became the norm, Taitron saw increased net sales while also working to keep improving gross margins. Taitron has been able to navigate a competitive environment with price wars and begin to return to improved profitability. Some pullbacks in earnings should be expected from the company’s recent guidance.

BTMA Stock Analyzer

Since earnings and price per share don’t always give the whole picture, it’s good to look at other factors like the gross margins, return on equity, and return on invested capital.

Return on Equity

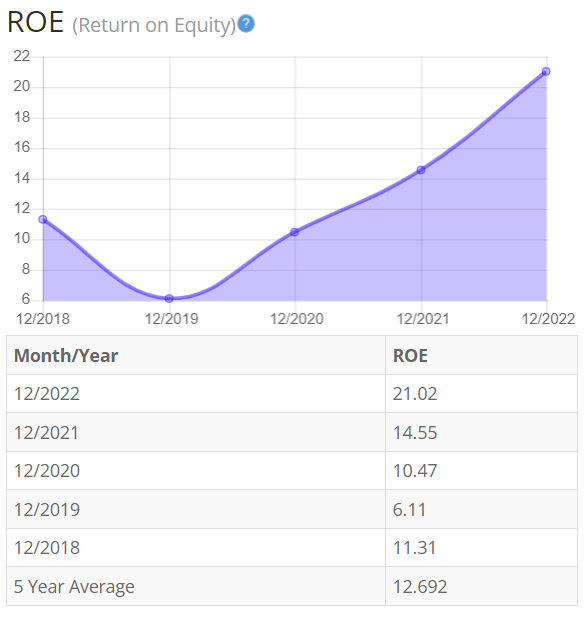

The return on has steadily risen since 2018 aside from an outlier in 2019. The results from 2019 highlight a decrease in consumer need for electronic components as the main driver for Taitron’s net income loss. The sales rebounded in 2020 and continued to rise due to component needs across the industry. Recent guidance has highlighted a potential decrease in inventory needs resulting in a potential ROE decline in the near term. For return on equity (ROE), I look for a 5-year average of 16% or more. So, Taitron Components does not meet my requirements.

BTMA Stock Analyzer

Let’s compare the ROE of this company to its industry. The average ROE of 60 semiconductor companies is 22.77%.

Therefore, Taitron Components’ 5-year average of 12.7% is below its industry peers.

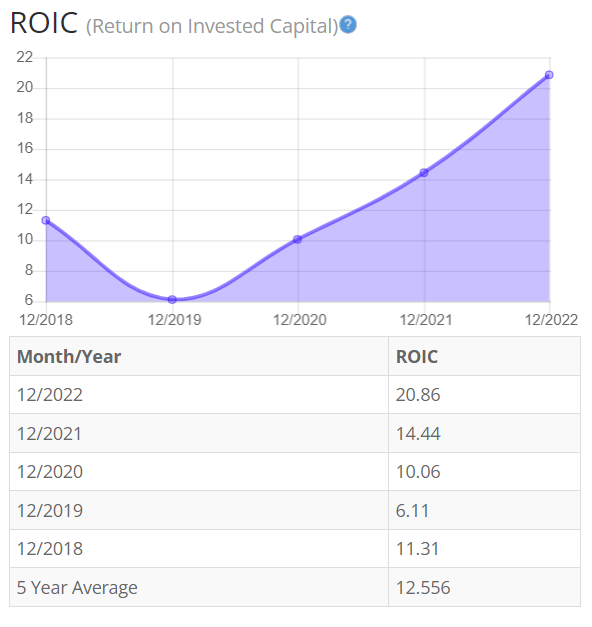

Return on Invested Capital

The return on invested capital again looks to match the ROE trend. Capital expenditure has remained relatively stable for Taitron. Seeing a steady rise in its ROIC shows that Taitron has good efficiency in returning gains from the same capital. The risk is that in this industry, technological advances are imperative to stay competitive and I don’t see Taitron investing in growth through PPE (property, plant & equipment) purchases. For return on invested capital (ROIC), I also look for a 5-year average of 16% or more. So, Taitron Components did not pass this test.

BTMA Stock Analyzer

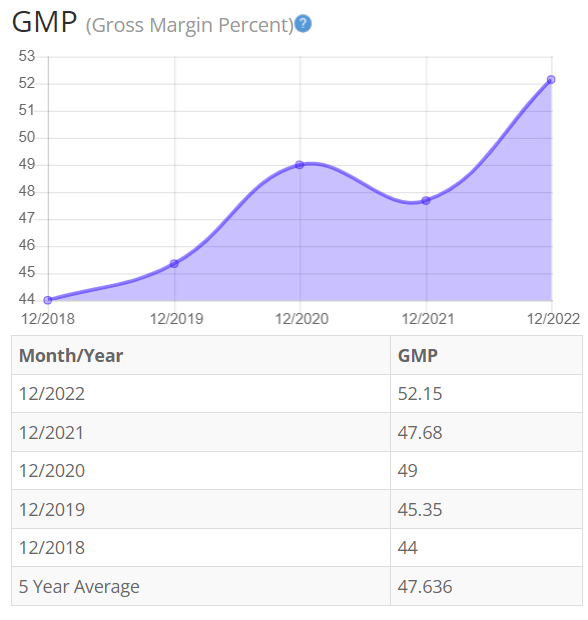

Gross Margin Percent

The gross margin percentage (GMP) has continued to rise overall. Taitron has continued to improve its gross margin over the last 5 years as component needs continue to increase. This allows Taitron to operate a more efficient facility and lower its unit cost. Another factor could be the strategic change in offering higher profit margin products due to its new specialized component strategy. Overall, this margin is exceptional for such a price-competitive industry.

I typically look for companies with gross margin percent consistently above 30%. So, Taitron Components does make the cut.

BTMA Stock Analyzer

Financial Stability

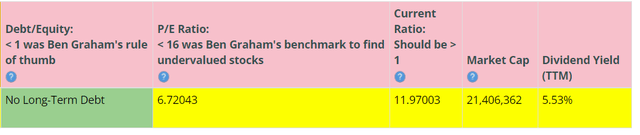

Looking at other fundamentals involving the balance sheet, we can see that the debt-to-equity is less than 1. In fact, it has no long-term debt. This is a positive indicator, telling us that the company can afford its obligations.

Taitron Components’ Current Ratio of 11.9 indicates it can easily pay off short-term debt with its current assets.

Ideally, we’d want to see a Current Ratio of more than 1, so Taitron Components is nearly twelve times this amount.

Taitron components is in amazing financial health. It currently has no long-term debt and large amounts of cash on hand. One possible concern about this information is due to the highly competitive nature of the industry. Not reinvesting in growth or taking much leverage in the company could allow competition to offer the same products either at a better price or with more functionality in the future. I would like to see more investment back into the business to foster growth, especially for a smaller-sized company like Taitron.

Taitron Components does pay a regular dividend, which is currently about 5.6% (5.53% over the past 12 months).

BTMA Stock Analyzer

This analysis wouldn’t be complete without considering the value of the company vs. share price.

Value Vs. Price

The company’s Price-Earnings Ratio of 6.72 indicates that Taitron Components might be underpriced when comparing Taitron Components’ PE Ratio to a long-term market average PE Ratio of 15.

The 10-year and 5-year average PE Ratio of TAIT (when removing outliers) has typically been about 11.6. This indicates that TAIT could be currently trading at a low price when comparing to its average historical PE Ratio range.

BTMA Stock Analyzer

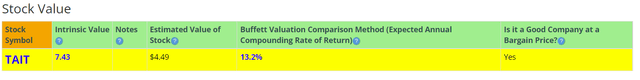

The Estimated Value of the Stock is $4.49, versus the current stock price of $3.57. This indicates that Taitron Components is currently selling below its value.

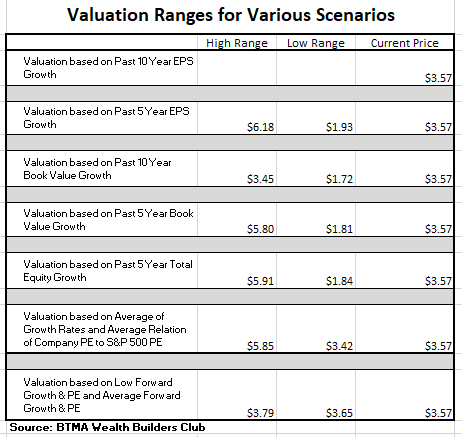

For more detailed valuation purposes, I will be using a diluted EPS of 0.30. I’ve used various past averages of growth rates and PE Ratios to calculate different scenarios of valuation ranges from low to average values. The valuations compare growth rates of EPS, Book Value, and Total Equity.

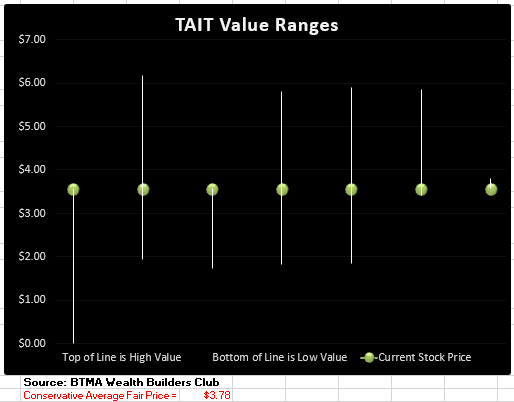

In the table below, you can see the different scenarios, and in the chart, you will see vertical valuation lines that correspond to the table valuation ranges. The dots on the lines represent the current stock price. If the dot is towards the bottom of the valuation range, this would indicate that the stock is undervalued. If the dot is near the top of the valuation line, this would show an overvalued stock.

BTMA Wealth Builders Club BTMA Wealth Builders Club

This analysis shows an average valuation of around $3.78 per share versus its current price of about $3.57, this would indicate that Taitron Components is fairly priced.

Summarizing the Fundamentals

After analyzing the fundamentals for Taitron Components, I believe this company has some potential red flags. The growth in component requirements alludes to potential long-term growth and investments in innovation, but the company’s business strategy does not lead itself to capitalize on that growth. Holding large cash reserves with no debt in a highly technological industry leads me to believe the company is not very interested in investing to generate higher growth. This leaves the company open to risk in terms of competition gobbling up its market share in the long term. Or possibly the company maintains its strong balance sheet with hopes that a bigger company might offer a large buyout of the company. The company does continue to improve sales and margin, but I believe these are more macro economy factors for component needs and not an actual competitive advantage of Taitron. I also don’t see any direct investment in cost reductions other than more unit cost efficiency due to increased need.

On a side note, the dividend and stock return have been excellent over the last six years. There could be some short-term potential in this stock due to the increased component needs and the large capital requirements to begin joining this industry as a competitor. Taitron has also consistently beaten the overall market these recent years and this trend could continue.

In terms of valuation, my analysis shows that the stock is about fairly priced.

Taitron Components Vs. The S&P 500

Now, let’s see how Taitron Components compares versus the US stock market benchmark S&P 500 over the past 10 years. From the chart below, we can see that Taitron Components consistently beat the S&P after 2017. This tracks with its previous fundamental improvement in earnings and share price over the period. Since the turnaround, Taitron has been a star player in anybody’s portfolio. There is certainly huge growth potential in this small company, if management continues to lead the company down the right path.

Morningstar

Forward-Looking Conclusion

There isn’t much analyst coverage of this stock. But, over the next five years, the analysts that follow this sector are expecting the sector to grow earnings at an average annual rate of 12.84%.

Currently, there are no analyst price targets for this stock.

The Expected Annual Compounding Rate of Return is 13.2%.

Here are the actual past results of Taitron Components.

______________

10 Year Return Results if Invested in TAIT:

Initial Investment Date: 9/5/2013

End Date: 9/5/2023

Cost per Share: $1.00

End Date Price: $3.53

Total Dividends: $1.05

Total Return: 358%

Compound Annualized Growth Rate: 16%

_______________

5 Year Return Results if Invested in TAIT:

Initial Investment Date: 9/5/2018

End Date: 9/5/2023

Cost per Share: $2.11

End Date Price: $3.53

Total Dividends: $0.80

Total Return: 105.21%

Compound Annualized Growth Rate: 15%

_________________

From these scenarios, we have produced results from 15% to 16%. I feel that if you’re a long-term patient investor and believer in TAIT, and its existing products (electronic components), you could expect TAIT to provide you with around at least 12-15% annual return over the long haul. But for the short-term swing trader or impatient investor, the near future of TAIT might show some volatility, or a slight pullback as suggested by the company’s guidance.

As a comparison, the S&P 500’s average return from 1928 – 2014 is about 10%. So, in a typical scenario with TAIT, you could expect to earn a much higher long-term return as compared with an S&P 500 index fund. The individual TAIT stock obviously doesn’t offer the diversification that the index fund does, but TAIT aims to offset this risk with their impeccable financial strength and reliable and hefty dividend payments.

Does Taitron Components Inc Pass My Checklist?

- Company Rating 70+ out of 100? Yes (71.9)

- Share Price Compound Annual Growth Rate > 12%? Yes (18.8%)

- Earnings history mostly increasing? Yes

- ROE (5-year average 16% or greater)? No (12.7%)

- ROIC (5-year average 16% or greater)? No (12.6%)

- Gross Margin % (5-year average > 30%)? Yes (47.6%)

- Debt-to-Equity (less than 1)? Yes

- Current Ratio (greater than 1)? Yes

- Outperformed S&P 500 during most of the past 10 years? Yes

- Do I think this company will continue to successfully sell their same main product/service for the next 10 years? Yes

Taitron Components Inc scored 8/10 or 80%. Therefore, Taitron Components shows solid fundamentals and should be considered as a potential investment.

Is Taitron Components Currently Selling at a Bargain Price?

- Price Earnings less than 16? Yes (6.7)

- Detailed Valuation Analysis average valuation of around $3.78 per share > Current Price of $3.57. Yes (Value $3.78 > $3.57 Stock Price) But I would like to have more margin of safety and to be able to buy at a greater bargain price to reduce risk.

Taitron Components has seen an exceptional rise in the last six years. Growing electrical component needs and improved manufacturing efficiency from this need have driven the company’s financials. This growth is expected to continue in the long term as component needs continue to increase even with the recent consumer spending decline in the short term.

My biggest concerns relate to the current business strategy of Taitron. The lack of a clear coherent growth strategy follows directly into its current large cash reserves and low leverage. This shows me the company is not investing as much in growth, which for a small market cap company in a highly competitive industry driven by technology could lead to being acquired or losing market share in the future.

The company also features a very order-by-order basis for its net sales leading to large fluctuations in net sales every year. On the other hand, there is peace of mind in knowing that this small company has potential for continued big growth. Taitron’s pockets are lined with cash and the company’s financials are exceptionally strong. In addition, the regular dividend of over 5.5% adds a nice reassurance. If I could obtain shares at a big enough discount, I would consider owning this small, but financially stable company.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here