Has My UiPath Thesis Changed?

In my last article on UiPath (NYSE:PATH), I made the case that they have the potential to develop a very strong moat. And now, almost half a year later, I believe that this is still a possible outcome for the future. PATH is in an industry with very strong growth opportunities where data and usability will play a large role. And these are exactly the points where PATH currently has a competitive advantage over its peers.

However, I do not believe that this is a risk-free investment. No one can say with 100% certainty how this industry will develop, but I think this is one of those cases where there is a huge upside potential that still justifies an investment at the current price.

PATH Q2 Earnings Preview

UiPath is moving away from being just an RPA company and transitioning to a business automation platform powered by artificial intelligence. Their plan is that they will be able to replicate what humans do and, with the help of generative AI, build automated workflows. They are still in the early stages, but they have built a competitive advantage based on the data they have collected, and the ease of use of the tool should allow people to use it without having to code. UiPath currently receives 2 million calls per day on its computer vision, which it can leverage in the future in combination with generative AI.

The stronger partnership with SAP is likely to have a positive impact on Q2 revenues, and we may also see the first impact of the Google (GOOGL) Workspace and UiPath VertexAi partnership, which is designed to deliver fast and cost-effective predictions. In general, UiPath partners with many companies and their products such as Microsoft’s (MSFT) Azure, Amazon’s (AMZN) AWS, Snowflake (SNOW), and some of the BIG 4 consulting firms. The second quarter should also see the impact of last year’s sales team changes in September.

In the presentation at Bank of America (BAC), they told a story about adidas (OTCQX:ADDYY) doing 1200 hours of automation in SAP, which clearly shows that there is a demand for this product. In addition, UiPath is looking for companies with specific data and industry expertise to partner with for automation development. This is a win-win situation for both companies and their customers.

The guidance for Q2 in terms of revenue was between $279 million and $284 million and I think that was a low guidance that they gave because of the tough economic environment and therefore they will probably beat that as well as the ARR numbers. Similarly, I think they are going to raise the guidance for FY24 a little bit and that they could probably even get above $1.3 billion in revenue. Most companies try to set the bar lower than they actually could to make it easier to beat guidance.

But it will be interesting to see how NDR did. They were on a downtrend last quarter, which some people did not like. 127% from the last earnings report is still a very strong result as it shows that customers like the product and probably get a positive benefit from using it. However, if the downtrend continues and they go below 100% in the future, I would be concerned.

I am equally excited about the FCF numbers minus SBC costs, as I think they will probably be positive somewhere in early FY25. I think that would be a real catalyst for the stock as it would mean that UiPath would be completely self-funding at that point.

UiPath Financial Situation

UiPath’s balance sheet is fortress like, with no debt and approximately $1.7 billion in cash and positive free cash flow last quarter. This gives them the financial flexibility to invest in R&D and to pursue M&A when they see attractive opportunities. Personally, I have no problem with them investing more in R&D, even if it means a short-term negative impact on the FCF. With the director of the UCL Center for AI, Dr. David Barber, they have a good person to lead their research.

PATH Growth Opportunities

The potential impact of ever-increasing automation will be huge in the future. ARK Invest (ARKK) has an interesting series of research papers on this topic, which you can read here. UiPath estimates the TAM at nearly $100 billion when you combine RPA, AI and ML. But depending on how it evolves, the market could be even larger.

Clipboard AI, coming in Q1 24, could have a big impact as the product will be able to transfer data between documents and paste it in the right place. This could be a game changer for many people. There is also Wingman, which is supposed to combine GPT and automation, which could also have a big impact.

And I think in the future every step will be automated in some way, so we are probably still at the beginning of the automation journey, and right now PATH has an advantage because their solution is more intuitive and easier to use than the competition. That may change in the future, but for now I do not think that the competition like Microsoft will dominate them as many fear.

Are There Any Risks That Could Seriously Affect The Future Of UiPath?

UiPath’s largest customer is in the $10M ARR range, so I do not see a concentration risk, and they also have many customers that have been with them for about 6 years and are still getting value from UiPath, which shows that they have a strong product that they are constantly improving.

However, one big risk I see is the large position of Cathie Woods and ARK Invest. They own more than 48 million shares and 8% of the outstanding shares. Should Ark ever decide to exit the position, this would have a significant impact on the share price. Because Ark is not known for holding its positions for very long. Their turnover is much higher than that of traditional value investors.

Conclusion

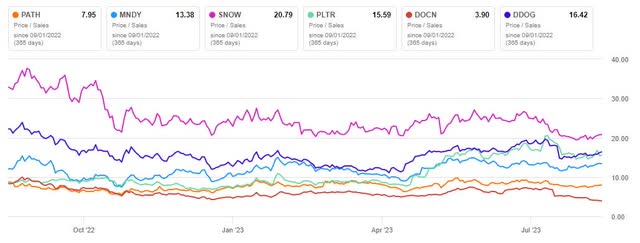

Seeking Alpha Peers Tab

One of the biggest advantages right now is that while PATH is expensive, it is nowhere near as expensive as some of the really pricey stocks. DigitalOcean (DOCN) is one of the few high-growth companies with a low valuation; almost all the other hyped companies have P/S ratios above 15x. This makes PATH an attractive risk/reward play, as the downside is a bit more protected.

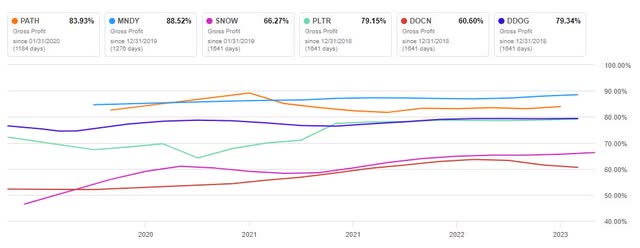

Seeking Alpha Peers Tab

Another place where PATH excels is in its very strong gross margins. The long-term goal is 85%, but can they get there and maintain it? And will they be able to translate the high gross margins into equally high EBIT margins? So there are definitely a lot of open questions that will determine the future of UiPath, and we may not know the exact answers for a few years.

However, in conclusion, UiPath will most likely raise its FY24 guidance while beating Q2 estimates, and it is a really interesting long-term play that has a lot of potential to deliver strong market beating returns over the next 5 to 10 years if they can deliver some of what we hope they can achieve.

Read the full article here