Listen below or on the go on Apple Podcasts and Spotify

The Fed chief echoes COVID-era prediction as FOMC holds rates. (0:16) Dot plot shows higher inflation, lower growth forecasts. (1:52) Stocks climb as yields retreat. (3:30)

This is a special Fed Day edition of Wall Street Lunch.

It’s déjà vu all over again.

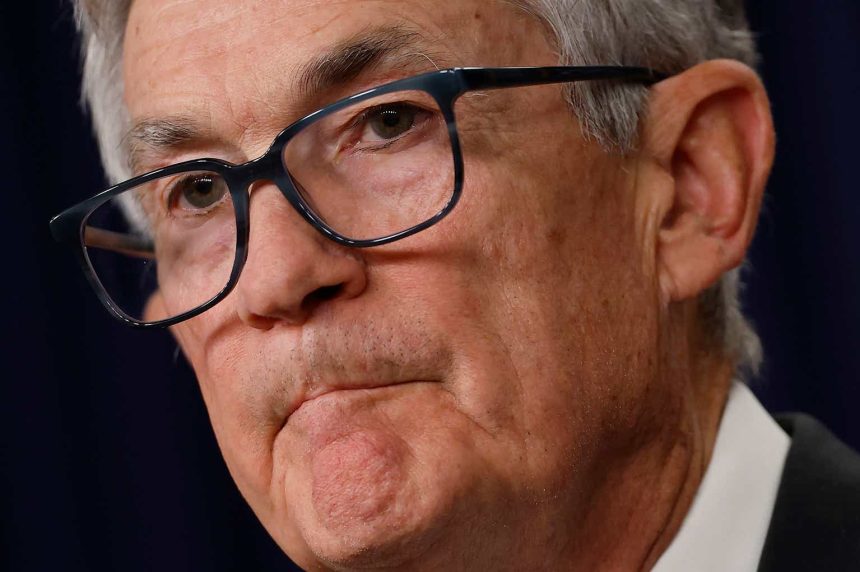

Chairman Jay Powell sent Fed watchers into a frenzy by bringing back the T-word.

After the FOMC kept interest rates steady as expected, Powell said at his press conference the “base case” is that the current uptick in inflation from tariffs will be transitory. Back in the summer of 2021, Powell made a similar claim in the midst of the COVID spike in inflation. Core CPI had risen to 4.5% back then, but went on to top out at 6.6% and took two years and a massive tightening cycle to settle back below 4%.

Economist Mohamed El-Erian says: “The word – ‘transitory’ — is back at the Federal Reserve as Chair Powell characterizes the price effects of tariffs as a one-off.”

“I would have thought that, particularly after the big policy mistake of earlier this decade and given all the current uncertainties, some Fed officials would show greater humility,” he added. “It’s simply too early to say with any regress of confidence that the inflationary effects will be transitory, especially given that companies and households still have fresh in their minds the recent history of high unanticipated inflation.”

Powell acknowledged that a “good part of” sticky inflation is tariffs, but the Fed is working on figuring out what are the tariff and non-tariff parts.

Progress on inflation is probably being delayed by tariffs “for the time being,” he added. But he did note that the last time there were tariffs the inflation was transitory and core PCE can get into the low 2s in 2026.

Powell was asked if inflation was transitory in relation to the new Summary of Economic Projections, or dot plot, which showed the same number of rate cuts as last time (two for this year), but also a rise in inflation and unemployment and a decline in growth in 2025.

Economist Ernie Tedeschi says: “That suggests (the growth and inflation impacts) are tariff-driven and the Fed is looking through them.”

But the SEP also indicated that the Fed members think things are more likely to get worse than better. Of 19 Fed members contributing to the SEP, those that see GDP risks to downside shot up to 18 members from 5 in December. Just 1 member sees risks broadly balanced, down from 12. Upside risks to core PCE inflation rises to 18 members from 15. Risks to the unemployment rate being to the upside up to 17 from 7, with just 2 seeing it broadly balanced, down from 12.

In its statement the FOMC replaced its phrase that risks to the economy on jobs and inflation were balanced and said: “Uncertainty around the economic outlook has increased.”

It also announced that it will reduce QT to $50 billion per month starting April.

T.S. Lombard economist Dario Perkins summed things up, saying the “Fed has basically updated it forecasts (higher inflation and lower GDP) for the tariffs that have been announced so far (plus a weaker start to 2025). Everything else is deferred until we get past ‘tariff day’ and actually have some clarity on the new administration’s plans.”

“People can talk about transitory all they like, but if inflation jumps 1% during Q2 it’s going to be mightily difficult to cut rates this year, unless there are clear cracks in the labor market,” he said.

As far as the markets are concerned, though, they either believe Powell can make transitory mean transitory again, or they think things will be bad enough that cuts will be inevitable.

Fed funds futures are still pricing in about a 20% chance of a quarter-point rate cut in May and a 65% chance of a cut in June.

Stocks rose after the decision, kept climbing as Powell spoke, saw the usual last-half-hour scalping but finished solidly higher. The S&P (SP500) closed up 1%, with the Nasdaq (COMP.IND) 1.4% higher and the Dow (DJI) up 0.9%.

Pantheon Macro economist Samuel Tombs says the “Markets don’t buy the hawkish tilt in the 2025 dots; it jars with the new economic forecasts.”

Treasury yields ended lower. The 10-year (US10Y) dipped back to 4.25% and the 2-year (US2Y) was back down at 4%.

But Strategist Marko Kolanovic said a Fed that’s “not in a hurry” means it will drag its feet when things get worse, like in the fall of 2018.

“This is not bullish at all.”

In other major news, SA Technology Editor Chris Ciaccia weighs in with his thoughts of Nvidia’s (NVDA) GTC so far, including CEO Jensen Huang’s keynote:

There was a lot to unpack for investors, developers, media and everyone else in between.

I think the biggest takeaways are obviously the new announcements of Blackwell Ultra, which is coming in the second half of this year, Rubin, which is coming in the second half of next year, and then you also saw the tease out of Nvidia’s products pipeline going out to 2027 and 2028.

Rubin Ultra, which is coming in the back half of 2027, and then a new line named after. American theoretical physicist Richard Feynman, which is coming in 2028.

So, there’s a lot of visibility that Nvidia has and is providing to, you know, your big hyperscalers like Microsoft, Amazon, Meta, Google, and the like, cause these companies are spending hundreds of billions of dollars over the next several years, and they need to know that that investment is going to be rewarded and Nvidia, I think, delivered on that.

I think some of the big takeaways that the sell side has is that Nvidia kind of expanded their total addressable market. They now see $1 trillion in AI capex spending by 2028, which is an enormous number.

Some of the other big takeaways are obviously the product pipeline that I mentioned earlier. And Nvidia is just hands down the leader in AI when it comes to accelerators, software with CUDA, Ethernet, with its MV link, and they’re just expanding on this.

It’s Nvidia’s ball game and there’s really nobody else even in the stadium at this point right now.

The stock and the market in and of itself are just kind of beholden to what’s coming out of Washington and until we get some clarity on that, you’re probably going to see the high volatility and the stocks are just goin bounce up and down based on what the tariff headlines of the day are.

So, the fundamentals of the company are getting better, but you’re not seeing that reflected in the stock price right now.

Among other active stocks in today’s session, Boeing (BA) saw buyers arrive after comments from CFO Brian West at an investor conference. West said the aviation giant is in “fantastic” shape in its effort to make 38 of its best-selling 737 Max planes a month.

General Mills (GIS) warned that is now sees adjusted EPS down 7% to down 8% for FY25 on a constant currency basis, compared to prior guidance for a range of down 3% to down 1%. Organic net sales are expected to fall in a range of -1.5% to -2.0% vs. a prior forecast for flat to +1%.

And Caesars Entertainment (CZR) announced the appointment of two new independent directors, Jesse Lynn and Ted Papapostolou, both from Icahn Enterprises (IEP), to its board. The expansion brings the total number of directors to 12, with 10 being independent.

And in the Wall Street Research Corner, global markets ETFs are posting double-digit returns, led by Poland (EPOL), up almost 40% this year.

The U.S. (SPY), on the other hand, is one just 10 countries lower YTD and six down more than 4%.

Charlie Bilello, chief market strategist at Creative Planning, says “This is why you just can’t have all your eggs in too few baskets. You just never know when there is going to be that reversion. You shouldn’t have been chasing that hot stock.”

Following Poland in the top 10 are Austria (EWO), Spain (EWP), China (MCHI), Greece (GREK), Germany (EWG), Chile (ECH), Italy (EWI), Colombia (GXG) and Finland (EFNL) – all up more than 20% in 2025.

Read the full article here