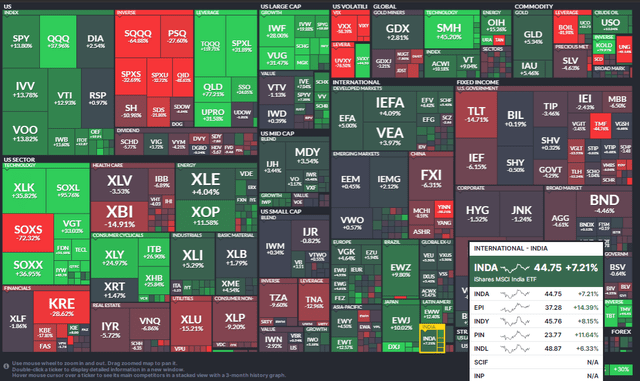

It has been a mixed bag in the non-US equity space so far in 2023. The below YTD ETF performance heat map illustrates that not all country funds are performing similarly. I highlighted the India market. There have been a handful of winners there, and one small ETF, homing in on small caps, has performed well given the rising population in that nation and its growing GDP.

I have a buy rating on the iShares MSCI India Small-Cap ETF (BATS:SMIN). I expect intermediate- and long-term upside, helping to build on its 2023 alpha over other India funds.

India Stocks Beating Most Other Emerging Markets in 2023

Finviz

According to iShares, SMIN seeks to track the investment results of an index composed of small-capitalization Indian equities. It can be used to express a specific view on the Indian market’s small-cap niche or paired with a broader Indian equity fund or Emerging Markets ETF for exposure to the entire Indian market. So far this year, SMIN is higher by 24% total return.

SMIN is a small ETF with just $483 million in assets under management and it pays a modest 0.1% trailing 12-month dividend yield, paid semiannually. The expense ratio of 0.74% is elevated but on par with similar non-US and India-focused funds. Where SMIN shines is with its robust momentum. As of September 16, 2023, the ETF is ranked number 1 in its sub-class and in the top 2% in all, per Seeking Alpha’s ETF Grades. Liquidity is a risk, however, since the average daily volume is under 100,000 shares and the 30-day median bid/ask spread can be wide at times, averaging 0.19%, so I urge investors to use limit orders with SMIN.

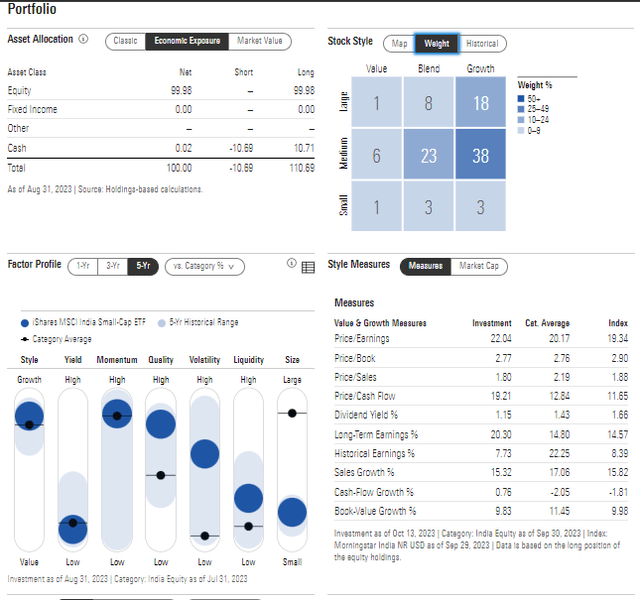

Digging into the portfolio, data from Morningstar reveal that SMIN actually holds a significant percentage of assets in mid-caps depending on one measure. Thus, the overall risk of the fund may not be as high as casual investors might first think. There is, though, a high allocation to the Growth style while just 8% of the fund is considered Value. With a high long-term EPS growth rate and favorable demographic trends, the low-20s P/E ratio is easily stomached. Income investors may wish to steer clear of the fund, but momentum is high while the quality of SMIN’s holdings is strong.

SMIN: Portfolio & Factor Profiles

Morningstar

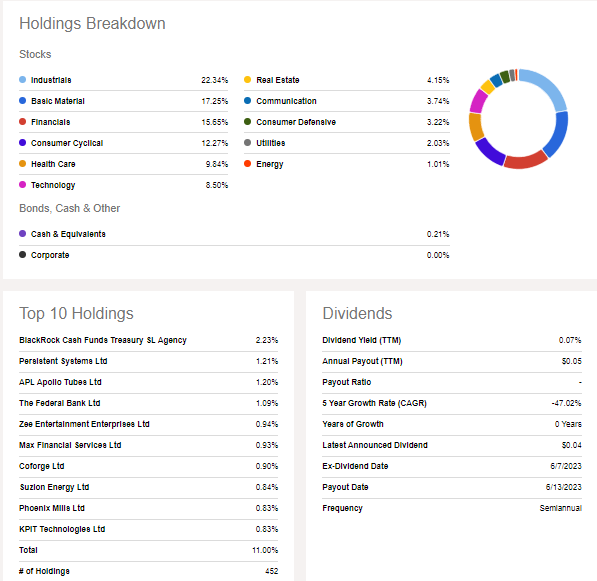

I like SMIN’s sector diversification. Four sectors feature weights of more than 10%, and Utilities & Energy – two lightly weighted sectors in the S&P 500 – are likewise small portions of this fund. Moreover, no single equity stake is more than 2.23% with the top 10 holdings representing just 11% of the ETF.

SMIN: Holdings & Dividend Information

Seeking Alpha

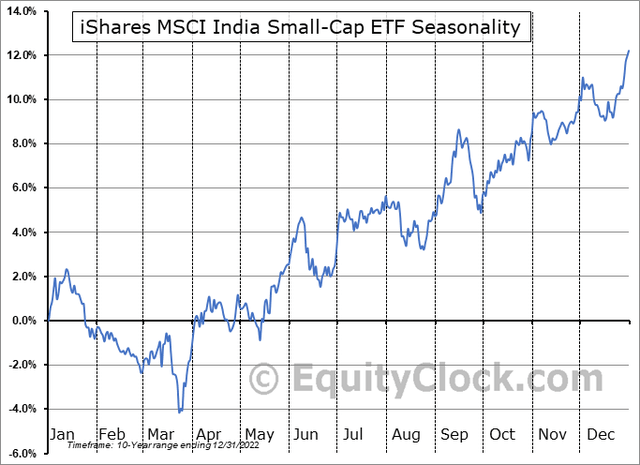

Seasonally, SMIN tends to rally at a steady clip for much of the year, but Q4 has historically been particularly strong, according to data from Equity Clock. While a secondary indicator to the fundamentals as well as price action, this is a positive signal to consider.

SMIN: Bullish Seasonal Trends Into Early January

Equity Clock

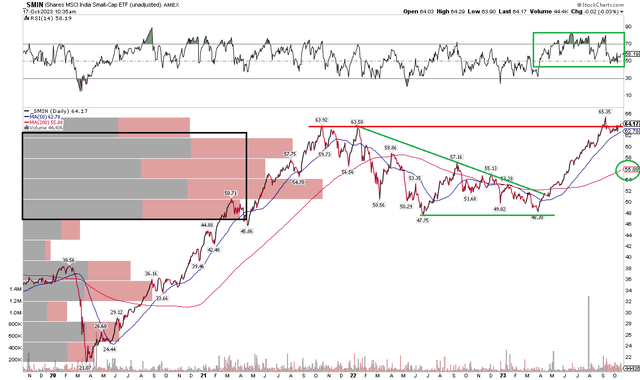

The Technical Take

SMIN has been a major winner since this past May. Notice in the chart below that shares are up more than 30% since interest rates began to really take off at that time in the second quarter. Today, the fund is revisiting its highs from late 2021 and early last year, so this is a natural area at which to pause. What I find bullish looking beyond a few weeks, though, is the strong RSI momentum range, indicated at the top of the graph. The 40 to 90 zone is generally considered the ‘bull zone,’ so SMIN is doing the right things from that perspective.

Also, consider that there’s ample volume by price in the $48 to $60 range – that should give SMIN support on any significant pullbacks over the coming months if they occur. After breaking out from a bullish descending triangle pattern in Q2, the trend has clearly inflected higher. That assertion is buttressed by the long-term 200-day moving average which is positively sloped.

Overall, the near-term suggests a pause, but the intermediate and longer-term trends look good in my view as SMIN flirts with all-time highs.

SMIN: Bullish Breakout, Pausing At All-Time Highs Amid High RSI Momentum

StockCharts.com

The Bottom Line

I have a buy rating on SMIN. Its valuation is reasonable given the growth outlook and considering very strong momentum. Though the fund might pause at its former all-time highs here, I expect the broader trend up to eventually resume.

Read the full article here