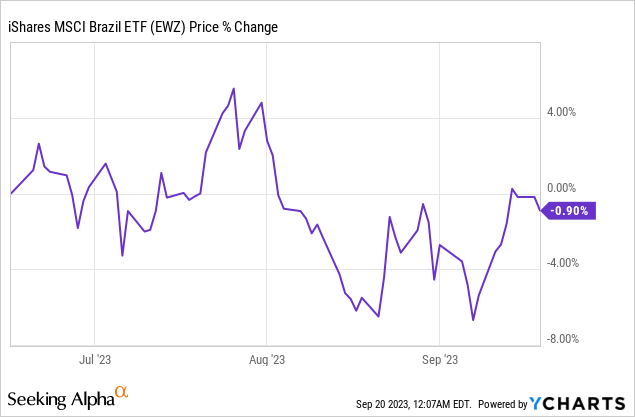

After experiencing a roughly 9% decline in August, the EWZ iShares MSCI Brazil ETF (NYSEARCA:EWZ) has displayed signs of recovery in September, albeit with some unevenness. At the time of writing, the ETF has remained nearly unchanged for the past three months.

Since my previous article in mid-August, the EWZ has regained approximately 5% of its value. In that earlier post, I highlighted how the Brazilian stock market’s (Ibovespa) strong bull run for most of the year seemed to falter. This downturn was attributed to thirteen consecutive declines, driven by negative sentiment from foreign investors and amplified by global concerns about the Chinese economy and rising Treasury yields.

Fast forward one month and my cautious outlook for Brazilian equities remains intact as no significant improvement signs were displayed. Business activity in Brazil slowed during the second quarter, although inflation has remained manageable despite a slight uptick in August. Additionally, fiscal uncertainties and global developments have caused the Brazilian real to weaken against the US dollar.

On a global scale, the Eurozone is undergoing a modest economic recovery but faces elevated inflation while China grapples with financial challenges. These factors directly impact Brazilian commodities, resulting in declining soybean and corn prices while oil prices increase. This trend could potentially impact the profitability of Petrobras, which is likely to continue lagging.

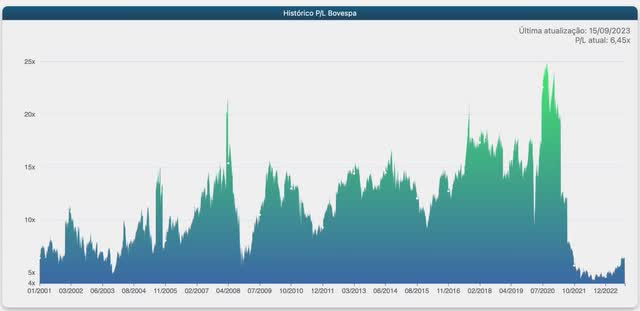

Given my belief that investing in emerging markets often requires adopting a more cyclical approach, I see EWZ as trading at an extremely attractive valuation compared to almost two decades ago. However, given the uncertainty surrounding the short-term improvement of key economic indicators, I remain skeptical about the prospects of rapid appreciation in the EWZ. Therefore, I maintain my neutral position in the short term.

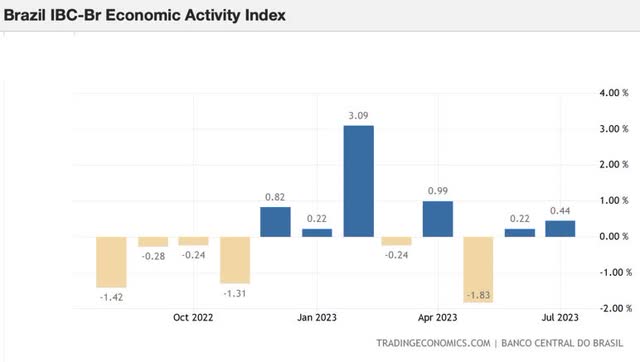

Economic Activity in Q2 Exhibits Deceleration

Considering seasonal adjustments, the Brazilian Central Bank’s Economic Activity Index (IBC-Br) increased by 0.6% in June compared to the previous month. As a result, it grew by 0.4% in the second quarter of 2023, a notable slowdown compared to the 2.2% growth observed in the first quarter. This suggests a substantial deceleration and the diminishing impact of Brazilian agribusiness.

Trading Economics / Banco Central do Brasil

In June, retail sales remained stable, while the sales volume in the services sector experienced a modest 0.2% growth. The stronger-than-expected performance in specific sectors, such as services, coupled with the labor market’s resilience since the beginning of the year, has contributed to a more gradual cooling of economic activity. The outlook points to lower GDP growth in the upcoming quarters due to high-interest rates, increased borrowing costs, high household debt levels, and uncertainties in the global economic environment.

Data from the Brazilian Federal Tax Authority indicates that the tax revenue and other collections totaled R$201.8 billion in July 2023, reflecting a year-over-year decrease of 4.2%. From January to July of this year, total revenue amounted to R$1.344 trillion, representing a 0.39% decline compared to the same period in 2022.

Turning to the fiscal landscape, the central government recorded a primary deficit of R$35.9 billion based on data from the Brazilian National Treasury. Over the past 12 months, a negative result of R$97 billion, equivalent to 0.95% of GDP, has been negative. The public and national debt reached 59.6% and 74.1% of GDP in July, respectively. Given the declining revenue and ongoing expenditure, Brazil is expected to conclude this year with a deficit of 1% of GDP.

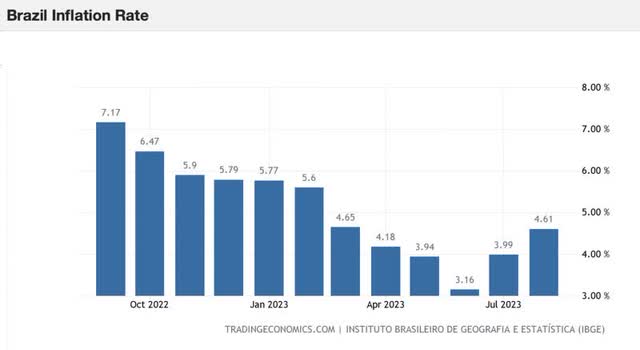

Inflation is Ticking Higher, but Not a Major Concern Yet

In August, the IPCA-15, a monthly inflation index in Brazil that measures price changes for the first 15 days of the month, showed a 0.28% increase. The inflation rate has risen over the past three months, reaching 4.61%, primarily driven by increased prices.

Trading Economics / IBGE

Notably, the components of the IPCA-15 demonstrate positive trends: prices for services, underlying services, the average of the core components, and the three-month moving average have all slowed down in August when considering the 12-month cumulative period.

Despite the IPCA-15 surpassing expectations, the overall inflation outlook in Brazil remains favorable. The IGP-M, an index known for its extensive coverage of consumer and wholesale prices and used as a reference for adjusting contracts, particularly in real estate and financial transactions, continues to register deflation. It declined by 0.14% in August and has decreased by 7.2% over the past 12 months, primarily influenced by falling producer prices. Lastly, the Focus Report (analogous to the FOMC meeting in the U.S.) indicates stable inflation expectations.

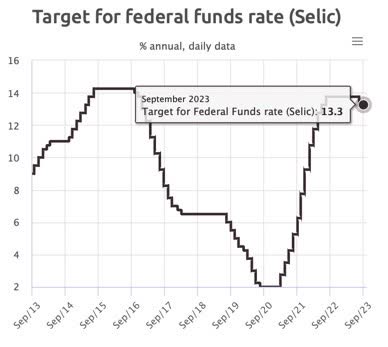

Interest Rates: A Cautious Downturn

In August, the Brazilian interest rate (Selic) remained at 13.25% annually. Throughout the month, Central Bank’s President Roberto Campos Neto and directors indicated that while inflation displays signs of improvement and is within the anticipated trajectory, specific segments still exceed desired levels. The battle against inflation is an ongoing concern. In this initial phase of rate cuts, they emphasized prudence and caution.

Brazil interest rate (Banco Central do Brasil)

The Brazilian Central Bank’s approach seems to be prudent. Market consensus for the next three meetings anticipates further reductions of 50 basis points (0.5 percentage points), bringing the Selic rate to 11.75% per year by the close of 2023. Looking ahead to 2024, the trend is for the Selic rate to continue declining and conclude the year at 9.25% per annum.

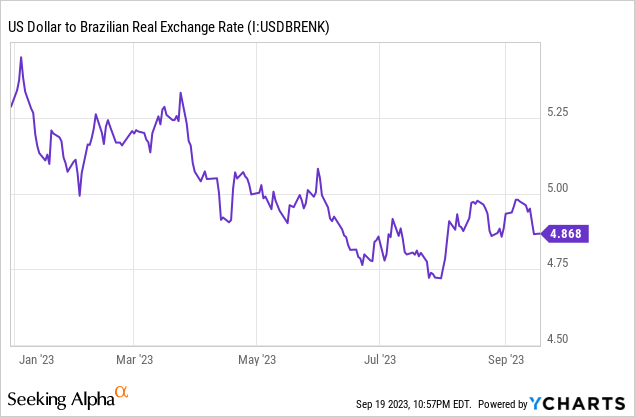

Brazilian Real (BRL) Depreciating Against the USD

In August, Fitch downgraded the United States’ credit rating from AAA to AA+, citing expected fiscal deterioration over the next three years and rising general government debt. Recent activity data showed a certain degree of resilience, which led to market concerns about the possibility of the Fed implementing new interest rate hikes.

Following its July close at R$4.74, the BRL-USD exchange rate reached R$4.92 in August. External factors also played a role, including the downgrading of the U.S. debt rating, uncertainties regarding the actions of the Federal Reserve (Fed), developments in the Chinese economy, and conditions within the Eurozone.

Due to the narrowing interest rate differential between Brazil and the United States, this increase was in line with expectations, even though it dropped to $4.86 in September. Domestically, political concerns and uncertainties regarding tax collection and adherence to fiscal targets contributed to the appreciation of the U.S. dollar.

Macroeconomic Turbulence in Europe and China

The Eurozone’s second-quarter GDP saw a modest 0.3% increase compared to 2023. A likely scenario is a slowdown by year-end, but two positive factors supporting economic activity are the robust labor market and the services sector.

Inflation is decelerating but remains elevated. It stood at 5.3% in July, down from 8.5% in February. Interest rates are expected to continue rising and remain elevated until inflation converges toward the 2% target.

Turning to China, recent data indicates that its economy is struggling to recover, marked by declining exports and imports, weak consumption, and a crisis in the construction sector. The government has implemented measures to stimulate consumption, capital markets, and real estate, yet these efforts are insufficient to ensure a robust Chinese economic recovery.

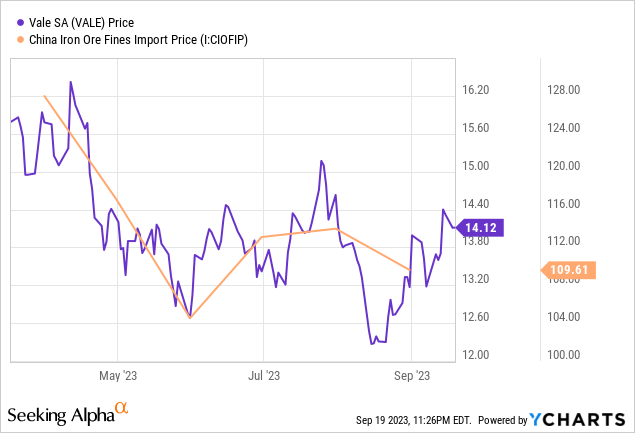

This situation has directly impacted Brazilian commodities. Despite the Chinese real estate crisis, iron ore prices have remained relatively stable due to recent government stimulus measures and increased demand from China resulting from minor cuts in steel production. Vale (VALE), representing 13% of the EWZ, reached 52-week lows at the end of August but gradually recovered in September, returning to levels seen in June and July.

Regarding agricultural commodities, record harvests in Brazil, improved weather conditions in the U.S., and reduced Chinese demand have led to lower soybean and corn prices. This trend is expected to persist in the coming months.

Regarding oil, several factors, such as positive seasonality, production cuts by OPEC, improved U.S. economic indicators and reduced U.S. stockpiles, have contributed to recent price fluctuations. It’s expected that oil will continue to hover around US$80-85 per barrel during the second half of the year. This situation presents challenges for Petrobras (PBR), representing 16% of the EWZ. Petrobras has been operating with a 14% lag (as of September 12th data) compared to Brent prices after discontinuing the international parity policy (IPP).

Brazilian Stocks Are Very Cheap

A significant shift occurred in the Ibovespa’s bull market in August, leading to fluctuations among index stocks. September has seen a partial correction of these declines.

During this period, a noteworthy trend emerged: companies with low correlation to the domestic market appreciated, while those heavily reliant on the domestic environment faced challenges. An illustrative example of this trend is the agricultural sector, which falls into the former category and experienced gains throughout the month. Conversely, the market penalized shares in the development sector companies.

Despite recent indicators pointing to a slowdown in economic activity and a rise in inflation – albeit seemingly under control – fiscal uncertainties and challenges in the macroeconomic landscape have gradually weakened the Brazilian real against the U.S. dollar. These factors have impacted Brazilian commodities, resulting in declining soybean and corn prices affecting Brazilian agribusiness. Additionally, Petrobras’ profits have been eroded in a high-price oil scenario.

Looking toward the long term, the investment outlook for Brazilian equities suggests that the risks may ultimately yield rewards. The Brazilian stock market still appears to be trading at an exceptionally low valuation multiple, approaching levels last seen in 2008 during the subprime crisis. The EWZ trades at a modest P/E ratio of 5.3x.

Brazilian stock market historical P/E ratio (Oceans 14)

Historically, investors who seized opportunities to purchase Brazilian equities during periods akin to the present one have often yielded favorable returns, provided they knew when to sell at the opportune moment. However, it’s essential to recognize that such opportunities can take time to materialize and may come with numerous challenges along the way. Investing in emerging economies like Brazil often involves specific entry and exit points, and the current environment could indeed be one for access.

Conclusion

I continue to view the conditions for Brazilian equities via the EWZ ETF as challenging, with limited positive indicators pointing towards a more optimistic short-term outlook. However, I maintain the belief that, on the whole, Brazilian stocks are presently trading at significantly discounted valuations and exhibit the resilience needed to navigate turbulent periods, which could positively influence the long-term perspective.

Read the full article here