Investment Thesis

As ARM Holdings (ARM) listing date is quickly approaching, it is worth taking a closer look at what price it would be reasonable to purchase the company’s shares. Based on my price-to-sales ratio model and revenue growth rates assumptions, the company’s shares seem to be expensive and therefore, it might be wise to wait for lower prices for a potential entry.

Corporate profile

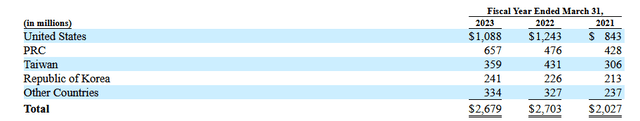

Unlike other semiconductor companies, ARM doesn’t manufacture microchips. It designs them. And then it licenses out these designs to other companies. The company’s products are used today by approximately 70% of the world’s population, ranging from smartphones, tablets, smartwatches, thermostats, drones to industrial robots. The company currently has around 6000 full-time employees and operates 5 geographical segments.

SEC

Source: Arm Holdings F-1 filing

Backed by big names

It’s already a second time the company is going public. The last time the company’s shares were listed on public exchanges was in 2016 when Softbank, the majority owner holding a 90 percent stake in the company, acquired the company took it private for $32 billion. In the upcoming IPO, big tech names and many of Arm’s customers such as Apple, Nvidia, Alphabet and Intel announced their interest in participating and purchasing well over $700 million worth of the company’s shares which won’t change much the ownership structure but certainly provides some support. Even though the big tech’s involvement has a rather symbolic mark in the ownership context now, who knows whether one day Arm Holdings gets bought by one of these names.

ARM Holdings + Softbank = Complex relationship

Prior to being purchased in 2016, ARM was listed on Nasdaq and London Stock Exchange from its first IPO in 1998 and SoftBank recognized a potential of a strategic investment, believing that Arm’s technology would play a crucial role in the emerging Internet of Things ((IoT)) market and other sectors. After the acquisition, there was a period of Arm’s autonomy, lasting approximately until 2020 when Softbank’s Vision Fund made significant investments in various technology companies at which Arm’s technology played a key role. In September, SoftBank announced a deal to sell Arm Holdings to NVIDIA for about $40 billion, which was one year later in 2021 cancelled due to regulatory hurdles and legal challenges.

Financial analysis

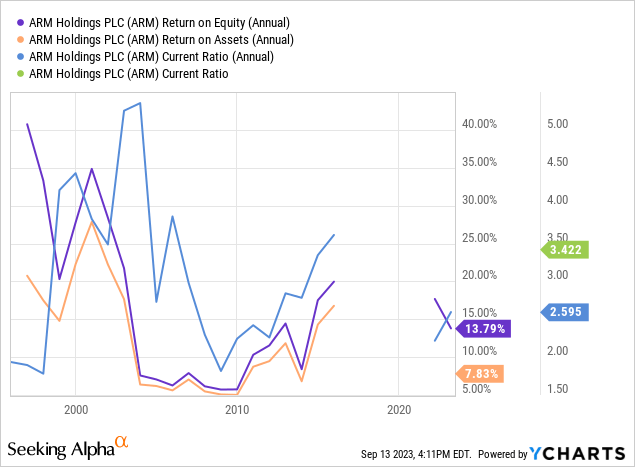

From financial perspective, Arm has solid profitability ratios – ROE hovering above 10 percent and almost a debt-free balance sheet. The company’s balance sheet is also highly liquid, which can be seen from Arm’s current ratios.

Ycharts

How much is ARM Holdings worth?

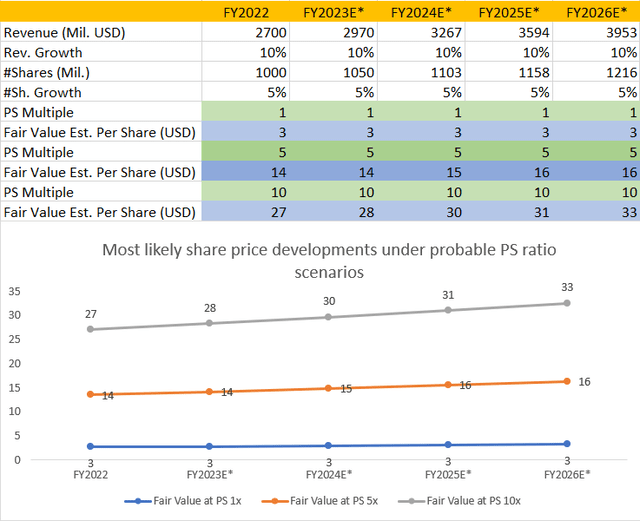

In light of revenue variation of popular Peter Lynch’s earnings line for the projection of probable per share values of the company, I see Arm Holdings’ IPO as quite expensive. According to my model assuming 10 percent annual revenue growth, 1 billion shares outstanding diluting at 5 percent annual rate and an average price-to-sales (P/S) ratio of 5x, the company’s intrinsic share value by the end of 2026 is forecasted to be around $16 USD. That’s way below the ‘official’ IPO price. Should the IPO price-to-sales ratio rather stand at 10x, the company’s implied share price by the model is around $30. Therefore, with such a high post-IPO implied PS ratio (around 15x – which is out of the usual mature tech PS range), the company’s shares seem, at least on a relative basis, to be a bit expensive.

Source: Author’s own model

Key risks

- Failure to attract new customers and sell additional products to existing ones may adversely affect the company’s financial condition.

- Intense competition could lead to a loss of market share and pressure on profit margins, the company estimates it commands an approximately 48.9% share of the market for semiconductor design.

- Customers might choose to license our architecture and develop their own processors, such did Intel (INTC) and AMD (AMD).

- As a s result, the company’s current pace of revenue growth may show to be unsustainable.

- Failure to innovate in response to technological changes could harm the company’s business.

- The company’s revenue is significantly tied to the People’s Republic of China PRC market, making us susceptible to political and economic risks in the region.

- The semiconductor industry depends on a limited number of manufacturers in specific regions, which poses risks to our operations.

- The company will be considered a “controlled company,” which exempts it from certain corporate governance requirements.

- Potential conflicts of interest between SoftBank Group and Arm’s other shareholders.

The bottom line

To sum up, I believe the Arm’s IPO is expensive, even though it had already traded at big valuation multiples in the past. Without a doubt, Arm’s business is quite unique, solid and consistently growing, but sobering after the IPO hype might bring better prices. As was the case of many companies that went public (Deliveroo, Wise to name a few), I can imagine we can see prices 50 percent lower than the proposed and agreed $47 to $51 a share initial offering price.

Read the full article here