General Motors (NYSE:GM) is an attractively valued player in the fast-growing electric vehicle market in the U.S. General Motors is a highly profitable company with an increasing electric vehicle line-up, an ambitious goals to increase the amount of EVs it will produce by FY 2025 and a strong free cash flow guidance for the current fiscal year. General Motors has guided for a massive expansion of its electric vehicle production volume in the next couple of years and the car brand is cheaply valued based off of free cash flow as well as earnings. Considering that General Motors has dropped off since July, I believe the risk profile is very favorable for investors to start a position!

Previous rating

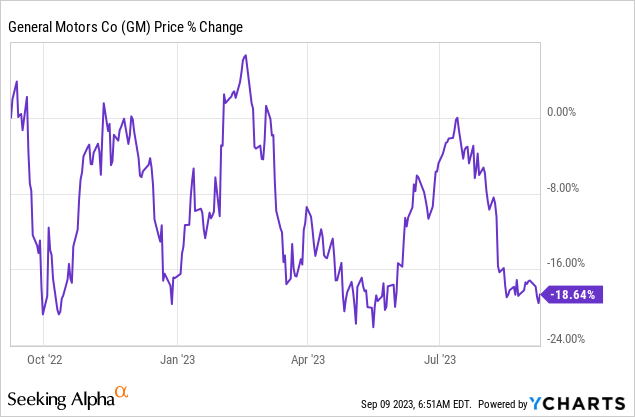

I rated General Motors a strong buy in September 2021 and the stock has declined more than 30% since. I recommended General Motors due to its electrification plans that began to take shape at the time. Since then General Motors has debuted new electric vehicles and laid out more aggressive goals for its EV segment (production as well as revenue goals). I believe General Motors overall offers investors much deeper value now that the product portfolio is becoming more dense, new product launches create revenue upside and shares are now much cheaper.

General Motors is set to grow its EV sales rapidly until FY 2025

General Motors is a serious contender for a leading market share in the global electric vehicle market. EV sales, due to generous government incentives around the world and rising adoption rates, are booming and legacy car makers like General Motors have gotten the message. General Motors has laid out ambitious EV goals and plans to invest billions of dollars in the ramp of its EV production: the car brand plans to achieve a 1M EV production volume in North America and $50B in EV revenues by FY 2025.

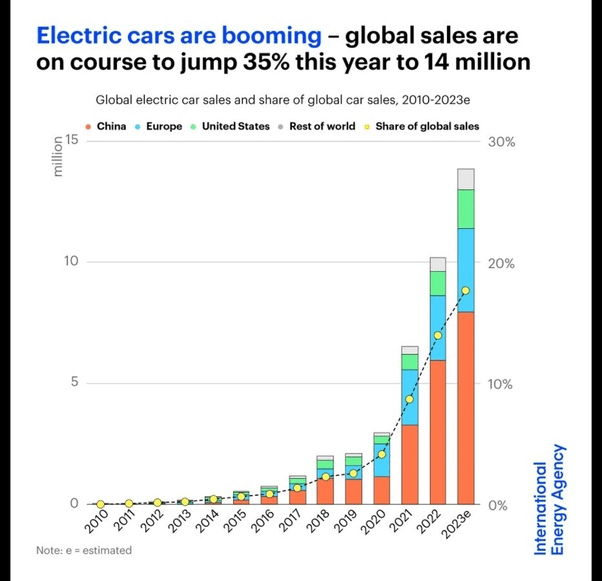

EV sales are soaring, not least because the U.S. is heavily incentivizing investments in electric vehicle technology and mobility solutions, including the build-out of a nation-spanning electric vehicle charging infrastructure. While China is still by the largest market for electric vehicles, Europe and U.S. are attractive markets for EV manufacturers as well as adoption is growing and government spending programs are help the auto sector transition to mass EV production. A concrete example is the U.S. Department Of Energy’s plan to invest $15.5B into the auto sector to help accelerate the shift toward electric vehicles. The plan includes, as an example, $2.0B for the retooling of factories in order to allow for the mass-production of electric vehicles.

According to the International Energy Agency’s “Global EV Outlook 2023”, the global EV market could see the sale of 14M EV passenger cars this year, potentially showing 35% year over year growth.

Source: International Energy Agency

General Motors’ electric vehicle line-up is increasing

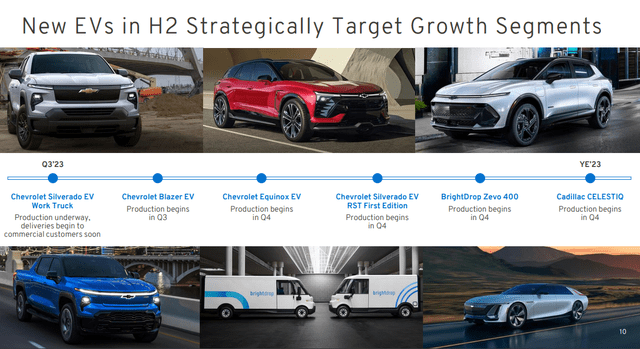

It is at a time of soaring electric vehicle sales and customer demand for clean energy/mobility solutions that General Motors is increasing the density of its EV product line-up. Just like Ford, General Motors is aggressively investing in EV production capacity, but also launching a growing number of electric vehicle products in the pickup truck and sport utility vehicle segments. General Motors, as examples, is set to launch a number of products including the Silverado EV pickup truck, the 2024 Chevrolet Blazer EV and the 2024 Chevrolet Equinox EV. General Motors’ flagship EVs are set to begin production in the second half of this year.

Source: General Motors

General Motors’ revised FCF forecast and valuation

General Motors has revised its free cash flow forecast upward for the second time in FY 2023. The car brand now expects to see adjusted free cash flow of $7.0-9.0B due to strong sales and strong pricing power for its existing vehicles, compared against a prior outlook of $5.5-7.5B.

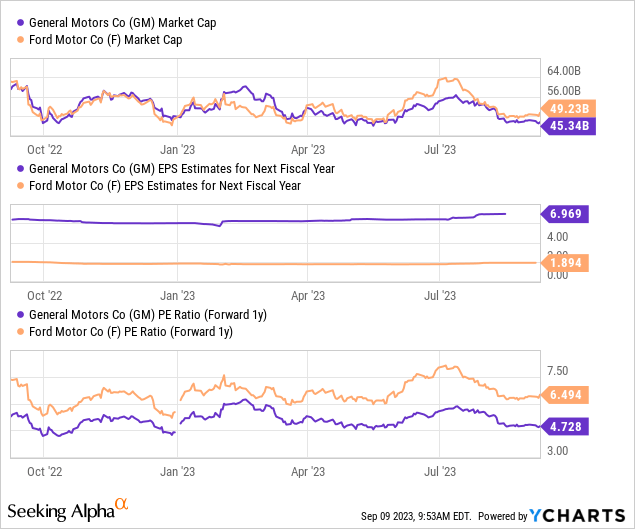

Ford (F), as an example, has guided for adjusted free cash flow between $6.5B and $7.0B. With market caps of $45B (for General Motors) and $49B (for Ford), General Motors has a valuation edge over Ford: its shares are trading at 5.7X free cash flow while Ford’s shares are valued at 7.3x free cash flow (the calculation has been based off of mid-point FCF guidance released in Q2’23 reports).

Based off of earnings, General Motors is also cheaper than Ford. Shares of General Motors are trading at 4.7X FY 2024 earnings while Ford has a forward P/E ratio of 6.5X. From a valuation perspective, General Motors appears to be better deal than Ford.

Risks with General Motors

Competition in the electric vehicle market is increasing and does not only come from focused niche players such as Lucid Group (LCID) or Rivian Automotive (RIVN), but increasingly from large-scale legacy car brands such as Ford or Volvo (through its investment in Polestar). Besides the growing risk of increasing competition (and pricing pressure), General Motors faces contract negotiations with United Auto Workers which could lead to strikes and factory shutdowns… which may put the company’s guidance for FY 2023 at risk. A U.S. recession, which some expect to take hold in FY 2024, could potentially limit General Motors’ revenue and free cash flow potential next year.

Final thoughts

General Motors is an undervalued and promising investment in the electric vehicle market. The car brand invests heavily into the expansion of its electric vehicle product portfolio and is set to grow its annual production capacity in North America to 1M electric vehicles by FY 2025. General Motors has a strong free cash flow guidance and considerable potential in the EV market given its large size. With considerable free cash flow power, an increasing EV product line-up, favorable industry tailwinds (growing electric vehicle adoption and increasing investments to accelerate the industry’s EV transition) as well as a low valuation, I believe the risk profile is favorable for investors in General Motors!

Read the full article here