Akamai Technologies (NASDAQ:AKAM) provides cloud infrastructure services for multiple applications. Although the company has a very long history of profitable growth, I believe the valuation is currently too high as Akamai’s growth seems to be fueled by constant acquisitions. For that reason, I have a sell rating for the stock.

Akamai’s offering consists of three main services, being cloud computing, security, and content delivery:

akamai.com

The company has a large focus on cybersecurity functions.

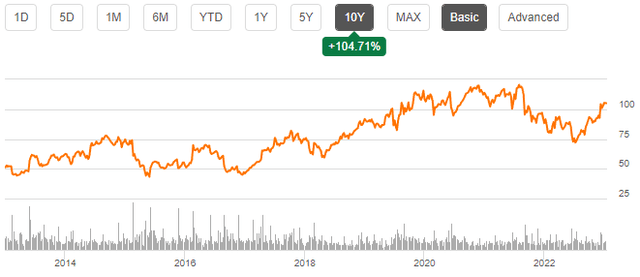

Akamai’s stock has risen by around 105% in the past ten years, making the CAGR a modest 7.4% for the period:

Akamai 10-year Chart (Seeking Alpha)

Financials

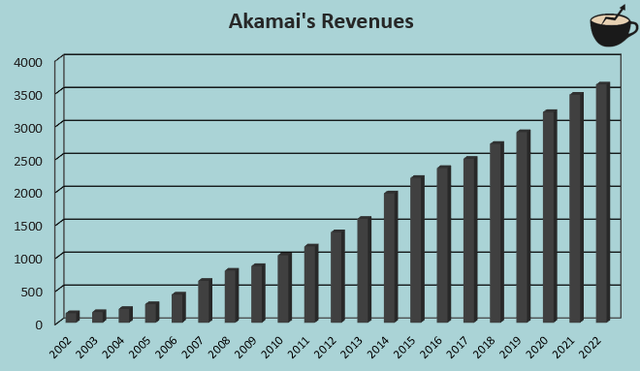

Throughout the company’s history, Akamai has achieved remarkable growth, as revenues have risen at a compounded annual rate of 17.4% from 2002 to 2022 – maintaining such a growth level for that long of a period is a large feat for any company.

Author’s Calculation using TIKR Data

Although the growth seems like a world-class performance at first sight, I believe the growth is not as valuable as one may believe – Akamai has a history of constant acquisitions to fuel the growth, hindering the company’s cash flows. For example, from 2013 to 2022, the company has had cash acquisitions totalling almost $2.8 billion. The acquisitions hinder Akamai’s ability to pay out dividends – the company does not currently pay out a dividend, and hasn’t done so. In the end, I am not too optimistic about Akamai’s growth.

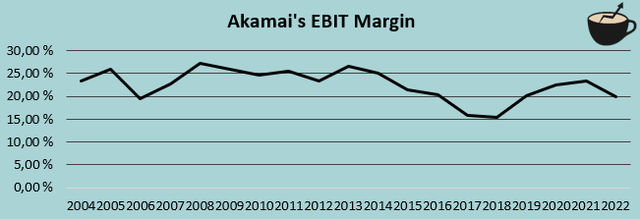

Akamai has kept its EBIT margin between 15% and 30% for most of its history. In 2022, the company achieved a margin of 19.9%, a bit on the lower side of the range:

Author’s Calculation Using TIKR Data

The company’s margin seems to be moderately stable, as I believe that the fluctuations are mainly caused by acquisitions with different margins compared to the main company.

Affecting the long-term EBIT margin, Akamai’s gross margin has quite consistently fallen in the long-term – in 2005, the company had very a high gross margin of 80.3%, with the trailing figure being significantly lower at 60.8%. The company has offset most of this effect with decreasing operating costs as a percentage of revenues – in 2005 the ratio was 54.4%, whereas with trailing numbers the ratio is 42.2%.

Akamai has a moderate amount of long-term debt. The company’s long-term debts total an amount of $2.3 billion – with a market capitalization near $16 billion, the amount seems reasonable. Akamai currently has almost no interest expenses, making the debt very cheap and rational to hold. Akamai also has a cash balance near $0.8 billion.

Valuation

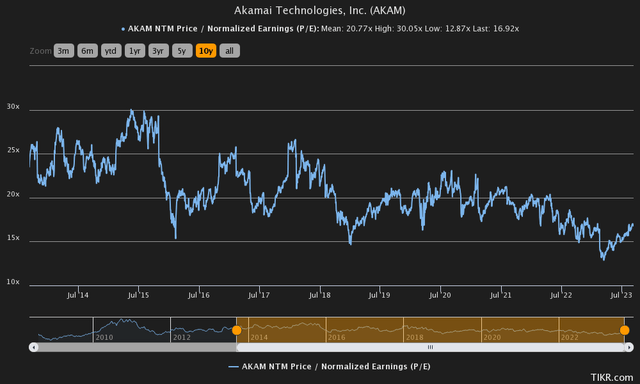

Currently, Akamai trades at a forward price-to-earnings ratio of 16.92. The ratio is below Akamai’s ten-year mean of 20.77:

Historical P/E (TIKR)

Yet, I am not very optimistic about the valuation. The price-to-earnings supposes an interest rate near zero for the company’s debt, which I don’t think to be sustainable in the long term. Akamai’s organic growth is also quite low, as the growth has been achieved through acquisitions.

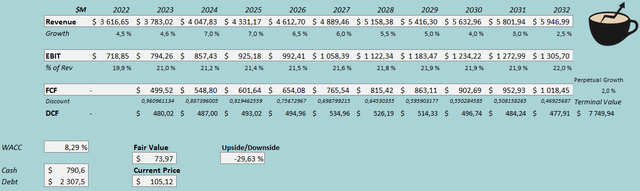

To get a better understanding of a fair value estimate for the stock, I constructed a discounted cash flow model. In the DCF model, I estimate Akamai to hit its 2023 revenue guidance of $3765 million to $3795 million. Going forward, I expect an annual growth of 7% which slows down into a perpetual growth rate of 2%. Unlike in most cases, I factor in acquisitions into the cash flow model – as the acquisitions of Akamai seem to be quite predictable and constant in their nature, I believe the transactions can be modelled in. I model in a lower amount of acquisitions than in the past to be conservative – the estimated 7% growth is well below the historical growth of 17.4%. The acquisitions take up less cash flows, though – the perpetual growth of 2% has no cash flow impacts from acquisitions.

I estimate Akamai to improve its EBIT margin slightly in 2023 into 21.0%. After the year, I estimate slight growth into an eventually achieved margin of 22.0%, near the company’s long-term average. These estimates along with a weighted average cost of capital of 8.29% craft the following DCF model scenario with an estimated fair value of $73.97, around 30% below the current price:

DCF Model (Author’s Calculation)

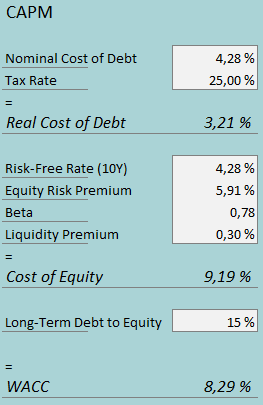

The used cost of capital is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q2, Akamai had $3.2 million in interest expenses – this would come up to an annualized interest rate of 0.55% for the company’s long-term debt. I don’t believe the interest rate represents Akamai’s long-term rate well, so I factored in an interest rate of 4.28%, expecting the rate to be around the United States’ 10-year bond yield. I estimate Akamai to leverage moderate amounts of debt, as in the model I estimate a long-term debt-to-equity ratio of 15%.

The same as the interest rate, I estimate the risk-free rate to be the United States’ 10-year bond yield of 4.28%. Professor Aswath Damodaran estimated in July that the US’s equity risk premium stands at 5.91%, used in the CAPM. The beta of 0.78 is taken from TIKR’s estimate that uses monthly data from five years. Finally, I add a small liquidity premium of 0.3%, crafting a cost of equity of 9.19% and a WACC of 8.29%.

Takeaway

Although Akamai seems like a fantastic long-term pick at first sight, the opportunity is clouded by a growth history fueled mainly by acquisitions. The company has had significant cash acquisitions in recent years but hasn’t achieved a growth that’s in line with its history – from 2016 forward, Akamai has only had a single year of double-digit growth. As my DCF model estimates a notable downside for the stock, I have a sell rating for the stock for the time being.

Read the full article here